In examining the extensive history of Bitcoin’s price fluctuations, you might be surprised to uncover intriguing patterns that shed light on future trends in the cryptocurrency market. As you explore the seven essential insights derived from Bitcoin’s price history analysis, you’ll gain valuable perspectives on the factors influencing its volatility and remarkable price movements.

Key Takeaways of Key Insights From Bitcoin Price History Analysis

- Bitcoin’s price history showcases significant volatility and price fluctuations.

- Increasing adoption and mainstream acceptance drive Bitcoin’s value and popularity.

- Regulatory concerns and debates highlight the need for robust frameworks.

- Bitcoin’s future outlook involves predictions, challenges, and evolving as a mainstream asset.

Bitcoin’s Early Price Trends

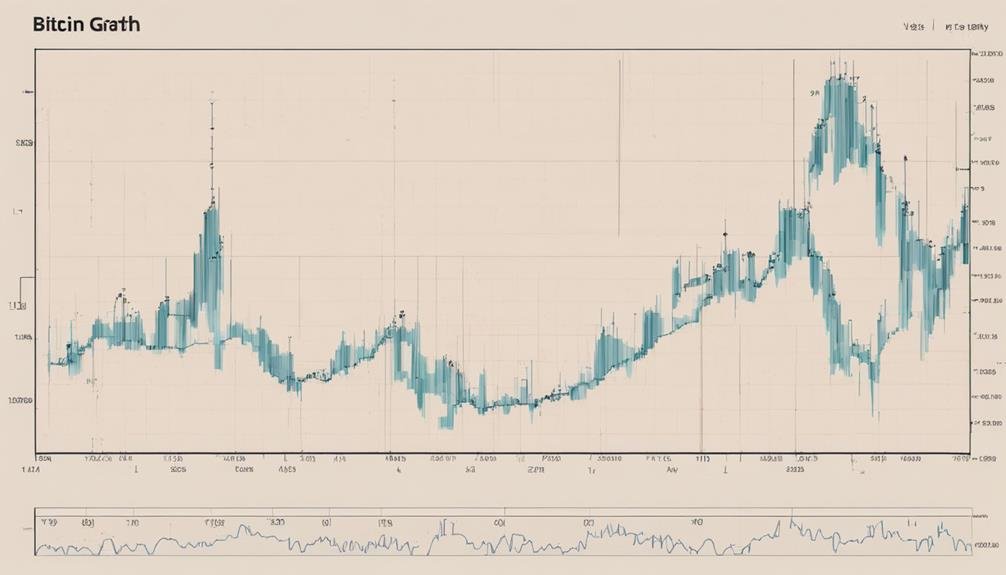

When analyzing Bitcoin’s early price trends, you will observe significant fluctuations from its humble beginnings in 2011 to critical milestones in subsequent years. Bitcoin’s price history reflects a rollercoaster ride of volatility and growth. In June 2011, Bitcoin surged to $30, plummeting to $2 by the year-end, closing at $4.70.

The following year, the first halving event occurred in November, contributing to the price movement ending the year at $13.50. Remarkably, in November 2013, Bitcoin experienced remarkable growth, tripling in price to over $1,200. However, this upward trajectory faced a setback in 2014 when issues with Mt. Gox caused a sharp decline, with Bitcoin dropping to $111.60 after reaching $1,000.

Despite these challenges, 2015 saw Bitcoin closing at $430, marking a year of adoption with the introduction of the official Bitcoin B symbol. Bitcoin’s early years were characterized by significant price fluctuations, highlighting the cryptocurrency’s evolving nature and the market’s response to various events.

Bitcoin’s Surge in Popularity

You can observe the rising demand for Bitcoin as more individuals and institutions seek to invest in this decentralized digital currency. The global adoption of Bitcoin played a significant role in its surge in popularity, with countries and companies increasingly accepting it as a legitimate form of payment.

This widespread acceptance of Bitcoin had a notable impact on financial markets, influencing investment strategies and reshaping how people perceive traditional currencies.

Rising Demand for Bitcoin

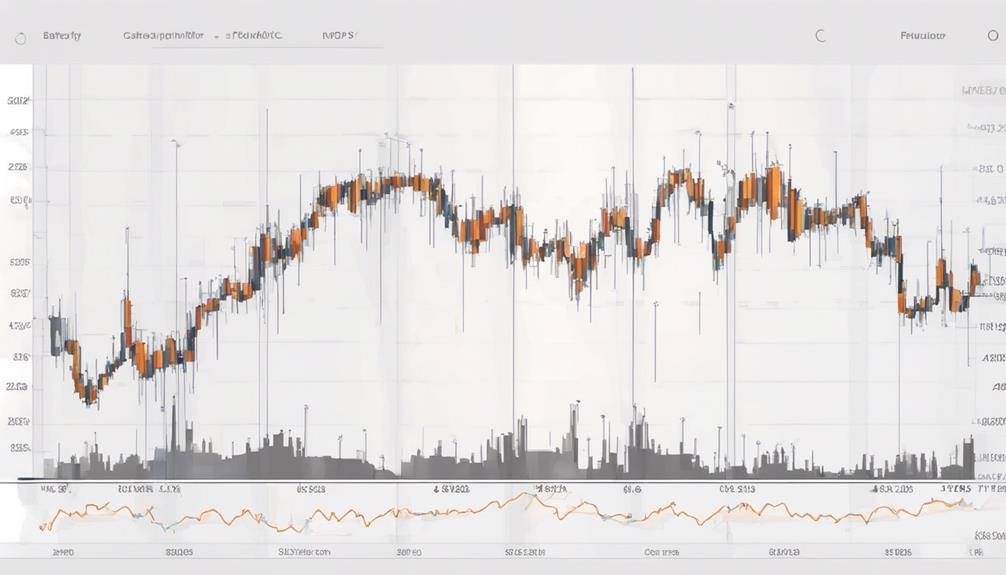

The exponential growth in Bitcoin’s value over recent years demonstrates the surging demand for this digital asset. From its price soaring from $433 to $959 in 2016 to reaching an all-time high of $68,649.05 in November 2021, Bitcoin’s popularity has been on a remarkable upward trajectory.

Even during the dip to $4,841.67 in March 2020, the demand for Bitcoin remained strong, showcasing resilience in the face of market fluctuations. As of February 29, 2024, Bitcoin’s current trading price of $61,113 further solidifies its sustained demand.

The historical analysis of Bitcoin’s price and value clearly shows its increasing popularity and the growing interest in this cryptocurrency as a valuable asset.

Global Adoption of Bitcoin

Bitcoin’s meteoric rise in global adoption, fueled by increasing mainstream recognition and acceptance, has solidified its status as a leading digital asset in the financial landscape. The surge in Bitcoin’s popularity can be attributed to various factors:

- Increased Awareness: Bitcoin’s price, hitting $1,000 in 2013, showcased growing global adoption.

- Widespread Recognition: The peak price of $19,345.49 in 2017 reflected worldwide acceptance and recognition.

- Mainstream Adoption: National awareness soared in 2017 when the price crossed $1,000, signaling mainstream adoption.

The adoption of Bitcoin as a payment method and investment vehicle expanded rapidly during the price surge 2017, indicating a rising global interest in this valuable asset.

Impact on Financial Markets

Amidst Bitcoin’s escalating popularity, its impact on financial markets has stirred heightened institutional interest and discussions surrounding its implications for the global economy. The surge in Bitcoin’s popularity has led to increased institutional adoption, pushing it toward mainstream acceptance within financial systems.

This adoption has not only influenced traditional financial markets. Still, it has also raised regulatory concerns and debates on its potential disruption to traditional banking systems. As Bitcoin continues to gain traction, the need for robust regulatory frameworks addressing its impact on financial markets and ensuring investor protection becomes more pressing.

The cryptocurrency market’s growth, propelled by Bitcoin’s popularity, underscores institutions’ need to navigate this evolving landscape while considering the broader implications on the global economy.

Bitcoin’s Recovery and Growth

As you analyze Bitcoin’s price surge and the market’s response to its recovery, you can pinpoint key indicators of its growth. The rise in Bitcoin’s value sparked renewed interest among traders, showcasing the cryptocurrency’s resilience. This period marked a recovery for Bitcoin and set the stage for its continued upward trajectory.

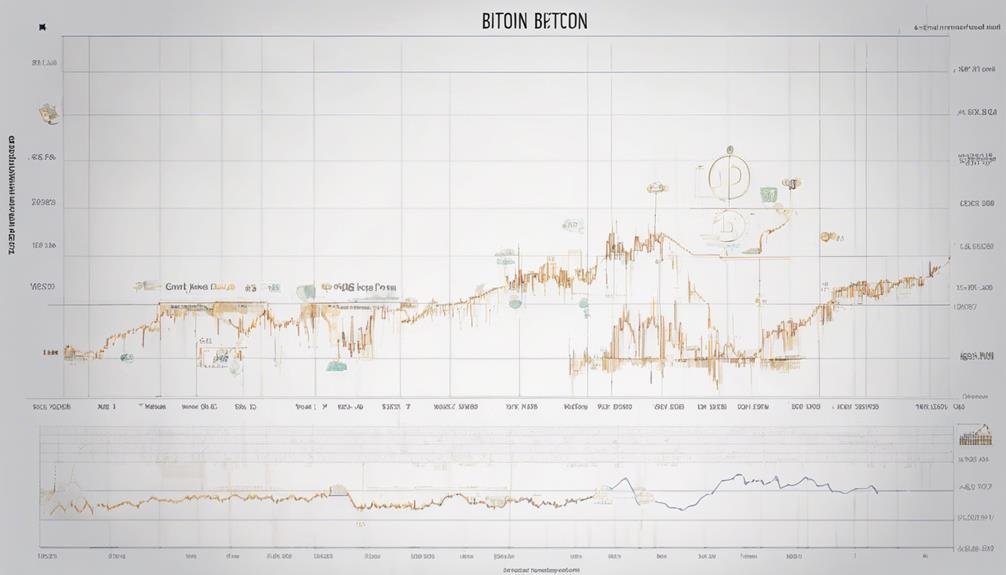

Bitcoin’s Price Surge

During the recovery and growth phase of Bitcoin’s price surge from 2018 to 2020, the cryptocurrency market witnessed a remarkable positive trajectory that captivated the attention of investors and traders alike. Bitcoin emerged as a compelling trading opportunity, with its price steadily increasing, attracting seasoned investors and newcomers.

The surge in Bitcoin’s price during this period highlighted its potential for significant growth and lucrative investment returns. Long-term holders of Bitcoin found this period particularly rewarding as the cryptocurrency’s value soared. This surge not only demonstrated the resilience of Bitcoin but also solidified its position as a valuable asset in the eyes of many in the financial world.

- Bitcoin became a compelling trading opportunity.

- The surge highlighted Bitcoin’s potential for significant growth.

- Long-term holders found this period particularly rewarding.

Market Response to Recovery

Following the surge in Bitcoin’s price from 2018 to 2020, the market response to its recovery and growth reflected a significant shift in investor sentiment towards the cryptocurrency. As Bitcoin exhibited resilience and attractive growth during this period, it emerged as a profitable investment and a sought-after trading opportunity.

Investors who recognized the potential of Bitcoin found profitable opportunities in its upward price trajectory. The market response highlighted the increasing attractiveness of Bitcoin as a valuable asset, showcasing its ability to recover from previous lows and surge to new heights.

This period served as a turning point for many, solidifying Bitcoin’s position as a promising investment option with potential significant returns.

Pressure on Bitcoin Prices

Pressure on Bitcoin prices stems from the intricate interplay of market forces, regulatory decisions, and investor sentiment, shaping the cryptocurrency’s price volatility. The following factors contribute to the pressure affecting Bitcoin prices:

- Market Corrections: Bitcoin prices face pressure from corrections that can occur due to various market dynamics and external factors.

- Regulatory Decisions: Decisions made by governments or regulatory bodies can have a notable impact on the stability and value of Bitcoin.

- Investor Sentiment: The sentiment of investors towards Bitcoin, influenced by news, trends, and overall market sentiment, plays a vital role in determining price movements.

Understanding these elements is vital in comprehending the complexities that influence Bitcoin’s price fluctuations. Investors can better navigate the pressures that affect the cryptocurrency market by considering supply constraints, demand shifts, technical indicators, and historical patterns.

Analyzing support and resistance levels provides valuable insights into the underlying forces impacting Bitcoin prices.

Debut of Bitcoin ETFs

The introduction of Bitcoin ETFs in 2024 revolutionized the investment landscape for cryptocurrency, offering enhanced accessibility and market expansion for investors. With the SEC allowing Bitcoin to be traded in ETFs on January 11, 2024, 11 fund managers were granted permission to list Bitcoin ETFs, notably broadening market access and providing new investment opportunities for a broader range of investors.

Before the ETF debut, Bitcoin’s price surged to nearly $49,000, reflecting heightened investor interest. However, post-launch, the price experienced a slight cooling effect as trading dynamics adjusted to the new investment vehicle. The availability of Bitcoin ETFs streamlined the process for investors to gain exposure to Bitcoin, influencing its price movements and trading impact.

This milestone marked a noteworthy moment in Bitcoin’s history, shaping its market behavior and opening doors to more diverse market participants looking to capitalize on the cryptocurrency’s potential.

Annual Bitcoin Returns

How have Bitcoin’s annual returns reflected the dynamic nature of the cryptocurrency market? Bitcoin’s historical data reveals a market characterized by extreme volatility, offering potential and risks for investors. Here are some critical insights into Bitcoin’s annual returns:

- Bitcoins have shown significant price appreciation, with returns exceeding 1,000% in some years. This highlights the immense growth potential within the cryptocurrency market.

- The global pandemic in 2020 tested Bitcoin’s resilience, resulting in a return of approximately 305%, demonstrating its ability to weather economic uncertainties.

- Despite the fluctuations, Bitcoin has presented investment opportunities, such as the remarkable 1,729% return in 2017, showcasing the lucrative nature of the cryptocurrency market.

Factors Influencing Bitcoin Prices

In understanding Bitcoin price fluctuations, one must consider the interplay of various factors that influence its value, such as supply and demand dynamics. Bitcoin’s price is intricately tied to its limited supply of 21 million coins, creating a sense of scarcity that impacts each coin’s value.

Halving events, which occur approximately every four years and reduce the rate of new Bitcoin creation, have historically led to significant price increases. The perceived value of Bitcoin, driven by factors like scarcity and demand, also contributes to its price fluctuations. Market significance plays a vital role in determining Bitcoin’s price movements, reflecting changes in supply and demand dynamics.

The intricate balance between supply, demand, scarcity, and market sentiment creates a complex ecosystem where Bitcoin’s price is subject to constant change and fluctuation. Understanding these factors can provide valuable insights into the dynamics behind Bitcoin’s price fluctuations.

Frequently Asked Questions

What Key Factors Influence Bitcoin Price?

Bitcoin’s price, market demand, regulatory changes, investor sentiment, technology advancements, mining difficulty, economic indicators, global adoption, market volatility, institutional interest, and social media impact all play essential roles in influencing its value.

What Is the Summary History of Bitcoin?

In Bitcoin’s journey, price fluctuations, market trends, investor sentiment, regulatory impact, adoption rates, technology advancements, supply, and demand played pivotal roles. Global events and economic indicators intertwined, highlighting a complex evolution.

What Is the Fundamental Analysis of Bitcoin?

When considering the fundamental analysis of Bitcoin, you should focus on factors like market trends, price movements, investor sentiment, technical indicators, market volatility, supply and demand, regulatory environment, global adoption, and economic factors.

What Are the Features of Bitcoin Price Prediction?

When predicting Bitcoin prices, you analyze market trends, technical indicators, sentiment analysis, historical data, and more. Utilizing machine learning, you improve forecast accuracy. Implementing sound trading strategies and risk management in volatile markets considers market psychology for informed decisions.

Conclusion

Bitcoin’s price history is a rollercoaster ride of ups and downs, peaks and valleys. Like a turbulent sea, it ebbs and flows, influenced by various factors and external pressures. Understanding these key insights can help navigate the volatile cryptocurrency market with a clearer perspective.

Stay informed, stay vigilant, and ride the waves of Bitcoin’s price movements with caution and strategy.