Starting your own crypto mining rig offers several strategic advantages. Primarily, it grants complete control over operations and decisions, unlike the reliance on mining pools. This autonomy can lead to increased earnings since miners reap the full benefits of their efforts. Additionally, a personal rig allows for cost-effective customization tailored to financial goals and operational efficiency, providing a hedge against cryptocurrency market volatility by accumulating assets at potentially lower costs. With the right equipment and management, individual miners can notably contribute to network security and transaction validation, ensuring stability within the ecosystem. Further insights into optimizing this venture await.

Table of Contents

Brief Overview of Setting Up An Ethereum Mining Rig

- Complete control over mining operations allows for personalized strategies and adjustments based on market conditions.

- Increased earning potential through direct rewards from mining efforts instead of sharing profits in a pool.

- Customizable mining setups can be tailored to fit individual budgets and performance goals.

- Accumulate cryptocurrency at potentially lower costs, hedging against market volatility.

Benefits of Setting Up a Rig

Establishing your own mining rig offers numerous advantages, including enhanced control over operations, increased earning potential, and active participation in the cryptocurrency ecosystem.

By building your rig, you retain full ownership of your hashing power, which can significantly boost your earnings. Unlike mining pools, where profits are shared, individual miners can directly benefit from their efforts, maximizing potential rewards.

Moreover, creating a customized mining rig allows for cost-effective solutions tailored to your budget and goals. This flexibility can lead to a more efficient operation, enabling you to optimize performance and energy consumption. A dedicated rig increases your chances of earning rewards. It is a hedge against market volatility, allowing you to accumulate cryptocurrency at a lower cost.

Additionally, owning a mining rig means actively participating in the cryptocurrency ecosystem. This involvement is essential, contributing to transaction validation and enhancing network security. By processing transactions, cryptocurrency miners play a critical role in maintaining the integrity and stability of the blockchain.

Setting up your own mining rig provides substantial benefits that can enhance your overall cryptocurrency mining experience.

Understanding Ethereum Mining

Understanding Ethereum mining requires a clear grasp of its mining process and the necessary hardware.

Miners utilize powerful GPUs or ASICs to solve cryptographic puzzles, validating transactions and earning Ether (ETH) as a reward for their computational efforts.

As the network’s mining difficulty fluctuates with the number of participants, it is essential to assess hardware requirements and potential electricity costs to optimize profitability.

Mining Process Overview

Ethereum mining involves miners solving complex cryptographic puzzles to validate transactions and secure the blockchain, ultimately earning Ether (ETH) as a reward. This mining process utilizes the Ethash proof-of-work algorithm, which demands significant computational power and is designed to be memory-hard, thereby resisting ASIC mining.

Cryptocurrency miners deploy high-performance GPUs, often constructed in rigs with multiple units, to enhance their hash rates and maximize their block rewards. Mining on the Ethereum blockchain requires miners to compete in solving these puzzles, a competitive endeavor influenced by network difficulty. This difficulty adjusts dynamically, ensuring that blocks are added approximately every 15 seconds.

The profitability of mining depends on several factors, including the current price of ETH, electricity costs, and, importantly, network difficulty. Miners must monitor these metrics closely to optimize their efforts.

While Ethereum mining was a popular avenue for generating cryptocurrency, it is worth noting that the network shifted to a proof-of-stake model as of September 2022. This change eliminated traditional mining, aligning with the broader shift within the cryptocurrency landscape, which includes mining alternatives like Litecoin.

Hardware Requirements Explained

A robust Ethereum mining rig requires specific hardware components that collectively enhance performance and efficiency in the mining process.

To maximize profitability, the rig should incorporate multiple high-performance GPUs, such as the NVIDIA RTX 3080 or AMD Radeon RX 6800 XT, which deliver superior hash rates. These GPUs are fundamental for handling the intensive computational tasks associated with mining.

In addition to powerful graphics cards, a minimum of 8GB of RAM is recommended. This guarantees that the operating system and mining software can operate efficiently alongside the demanding GPU workloads.

The power supply is another significant component; a reliable PSU with at least 1000 watts capacity is necessary to support multiple GPUs and maintain stability during high energy demands.

Moreover, effective cooling solutions, such as additional fans or liquid cooling systems, are essential to prevent overheating, given the substantial heat generated during operations.

Finally, selecting a motherboard that accommodates multiple GPUs and is equipped with adequate PCIe slots is imperative for scalability, allowing miners to expand their mining rig as needed.

Understanding these hardware requirements is fundamental for constructing an efficient and profitable Ethereum mining rig.

Essential Equipment for Mining

Selecting the right equipment is essential for enhancing the efficiency and profitability of a crypto-mining operation.

A well-assembled mining rig typically requires a motherboard that supports multiple graphics cards to maximize computing power. High-performance graphics cards, such as the Nvidia RTX 4090 or AMD Radeon RX 580, are crucial for achieving higher hash rates, directly impacting mining profitability.

Additionally, a robust power supply unit (PSU) must be chosen to match the total wattage requirements of all components, ensuring stable power delivery and preventing hardware failures that could disrupt operations. Adequate cooling systems, whether through fans or liquid cooling, are critical for maintaining ideal operating temperatures, especially during prolonged mining sessions. Overheating can significantly reduce the lifespan and efficiency of the equipment.

Storage options like solid-state drives (SSD) or hard disk drives (HDD) are necessary for installing the operating system and mining software. While both options serve this purpose, SSDs offer faster data access speeds, enhancing overall mining performance.

Therefore, investing in the right combination of equipment is fundamental for a successful and profitable mining venture.

Choosing the Right Hardware

Choosing the proper hardware is fundamental for maximizing the performance and profitability of a crypto mining rig.

Successful mining operations hinge on several key components, with the graphics processing unit (GPU) being paramount. For instance, high-performing GPUs like the RTX 4090 can greatly enhance mining efficiency, while ASIC miners such as the Bitmain Bitcoin Miner S19 XP are tailored for improved Bitcoin mining.

In addition to a powerful GPU, a minimum of 8GB of RAM is recommended to guarantee smooth operation. The motherboard must support multiple GPUs, enabling scalability and increased hashing power that directly impacts profitability.

Moreover, the power supply unit (PSU) is essential; it must meet the total wattage requirements of all hardware components to prevent failures during high-demand operations.

Equally important is the cooling system. Effective cooling solutions, whether through high-capacity fans or liquid cooling, are crucial to maintaining ideal temperatures and extending the lifespan of mining rigs.

Building Your Mining Rig

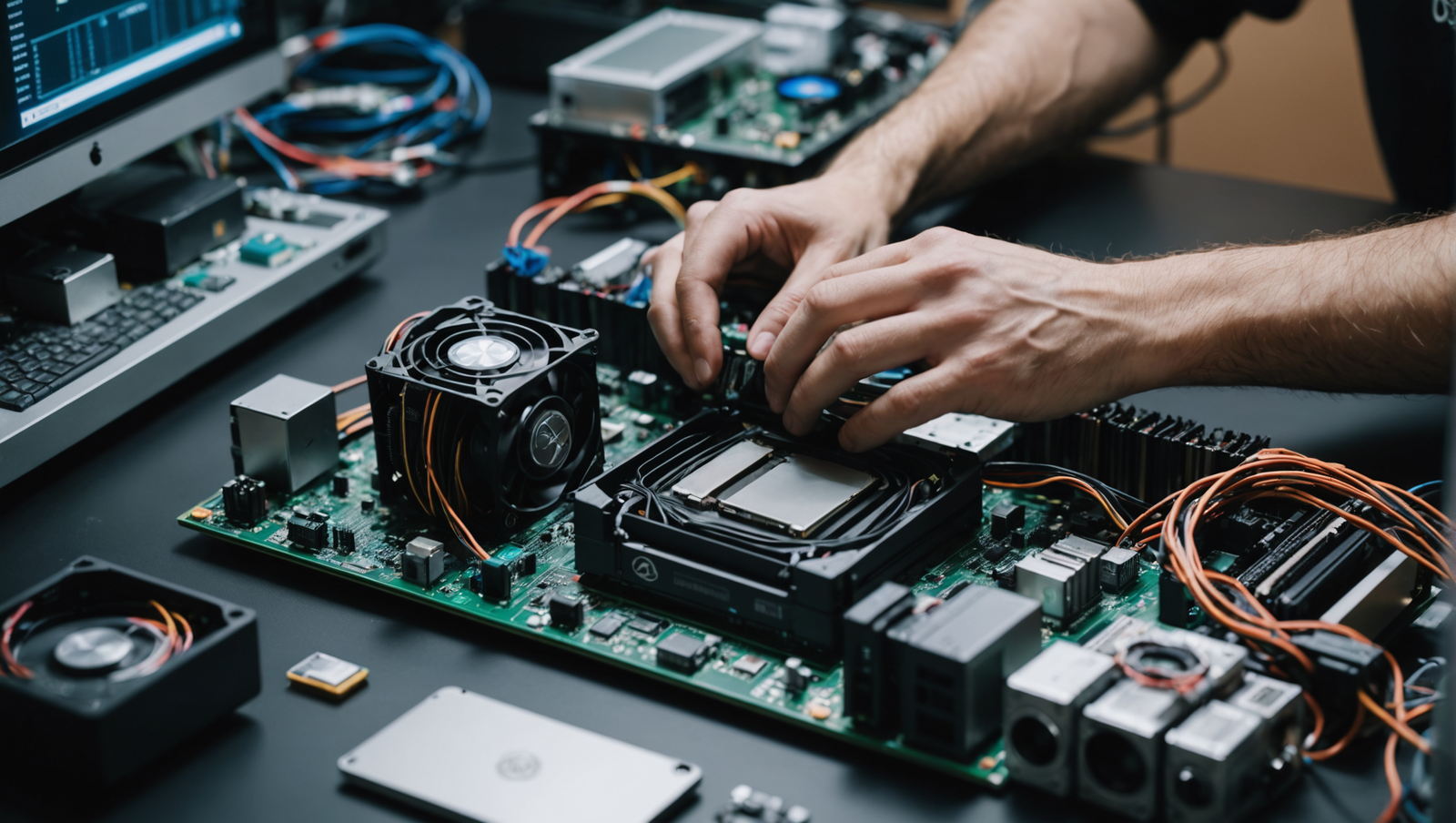

Building a mining rig requires careful consideration of the components to guarantee peak performance and efficiency in cryptocurrency mining. Central to this process is the motherboard, which should support multiple graphics cards (GPUs) to maximize mining capabilities.

Selecting the right GPUs is critical, as they directly influence hash rates. Popular choices include the GTX 1070Ti and Radeon RX 580, which are known for their performance and cost-effectiveness.

Equally important is the power supply unit (PSU), which must provide sufficient wattage to accommodate all components, ensuring stable operation. A PSU that matches or exceeds the total wattage requirement is necessary to avoid power-related issues.

Implementing effective cooling systems is also essential, as continuous operation can lead to overheating. Options range from standard fans to more advanced liquid cooling solutions designed to maintain ideal temperatures.

Mining Software Options

Various mining software options are available, each designed to cater to different hardware configurations and user preferences in the cryptocurrency mining landscape. Selecting the appropriate software is vital for optimizing mining performance and profitability. Here are some notable options:

- CGMiner: A versatile, open-source software that supports multiple operating systems and offers advanced features for experienced miners.

- BFGMiner: Tailored for FPGA and ASIC hardware, this open-source software emphasizes monitoring and management capabilities, making it suitable for dedicated miners.

- NiceHash: Known for its user-friendly interface, NiceHash automates the mining process and allows users to mine various cryptocurrencies based on real-time profitability data.

- Remote Monitoring: Many mining software solutions include features for remote monitoring, enabling miners to oversee their operations from anywhere and increasing efficiency.

These mining software options support various operating systems, including Windows, Linux, and macOS, and empower miners to customize their operations for improved results and adaptability in a dynamic market.

Joining an Ethereum Mining Pool

Joining an Ethereum mining pool<span data-preserver-spaces=”true”> presents several advantages for miners seeking to enhance their efficiency and profitability.

By pooling resources, members can increase their collective hash power, which improves the likelihood of solving blocks and receiving consistent rewards. This is particularly beneficial for those with lower individual hash rates.

When selecting a mining pool, factors such as pool fees, payout reliability, and the overall performance metrics provided by the platform must be taken into account. This ensures optimal returns on your mining investment.

Benefits of Mining Pools

Participating in an Ethereum mining pool dramatically enhances the likelihood of earning consistent rewards by leveraging collective hashing power with fellow miners. This collaborative approach increases the chances of successfully mining a block. It provides a more stable income than solo mining endeavors.

The benefits of joining a mining pool include:

- Increased Earnings: Miners can achieve regular payouts based on their contributed hash rate by pooling resources.

- Consistent Rewards: Mining pools offer more predictable returns, reducing the volatility associated with individual mining efforts.

- Enhanced Network Hash Rate: Large pools contribute considerably to the network’s total hash rate, improving their chances of finding new blocks.

- Beginner-Friendly Interfaces: Many pools provide user-friendly tools and dashboards, making it easier for newcomers to monitor their performance and earnings.

Pool Selection Criteria

Critical criteria must be considered to guarantee ideal profitability and reliability when evaluating an Ethereum mining pool. One of the primary factors is the pool’s hash rate; pools with higher hash rates typically offer more frequent payouts, enhancing overall profitability.

Additionally, examining the payout structure is essential. Pay-Per-Share (PPS) or Pay-Per-Last-N-Shares (PPLNS) can significantly influence how and when earnings are distributed.

Low fees are another vital aspect of pool selection criteria. Mining pools often charge fees ranging from 0% to 3% of earnings; consequently, selecting a pool with lower fees can improve returns.

User reviews and performance history should also be scrutinized, as they provide insight into the pool’s reputation. Consistent payouts and reliable performance are critical for maximizing mining rewards.

Lastly, a user-friendly interface and robust support are significant features. These elements facilitate efficient mining activity management and help address any issues that may arise.

Maximizing Mining Efficiency

How can miners enhance their efficiency and profitability by leveraging the collective power of an Ethereum mining pool?

Joining a mining pool notably increases the likelihood of solving blocks and receiving rewards compared to the unpredictable nature of solo mining. By combining their hashing power, cryptocurrency miners can enjoy several advantages:

- Increased likelihood of block resolution: Pools collectively tackle the mining process, enhancing the chances of solving blocks quickly.

- Stable income: Miners receive payouts based on their contributed hashing power, providing a more reliable revenue stream.

- Reduced variance in earnings: Participating in a pool minimizes the risk of long periods without rewards, which is common in solo mining.

- User-friendly interfaces: Many mining pools offer intuitive platforms that display real-time statistics, allowing miners to track their performance and earnings effortlessly.

Calculating Profitability and Costs

Calculating the profitability of a crypto mining rig requires careful consideration of initial setup costs, ongoing electricity expenses, and market fluctuations in mining difficulty and cryptocurrency prices.

The initial setup costs can be substantial, with hardware such as ASIC miners or high-performance GPUs costing between $2,600 and over $4,600. These costs are essential in determining the overall investment.

Power expenses also play a significant role; for instance, at local rates of $0.10 per kWh, a rig consuming 1000 watts could incur monthly expenses exceeding $72, further reducing net earnings.

Additionally, joining a mining pool can be beneficial since it allows miners to combine hash rates, improving the chance of receiving consistent rewards, especially when facing high difficulty levels.

Considering the breakeven point is essential, as it often takes years to achieve profitability, particularly with multi-GPU setups. Consequently, miners must maintain realistic expectations about their potential earnings and the time frame to recoup their investments.

Regularly monitoring mining difficulty and cryptocurrency prices is critical for recalibrating expectations and effectively evaluating return on investment (ROI).

Managing Your Mining Operations

Effective management of mining operations is essential for optimizing performance and ensuring the longevity of your equipment. By tracking key metrics such as hash rate and power consumption, miners can adjust their strategies to enhance efficiency. Mining management software can notably streamline the process, providing real-time monitoring and alerts for operational issues.

To effectively manage your mining operations, consider the following strategies:

- Regular maintenance: Clean hardware and update software to prevent downtime.

- Monitor critical metrics: Track hash rate and power consumption for optimization.

- Join a mining pool: Collaborate with others to increase chances of consistent rewards and access to shared resources.

- Reinvest earnings: Strategically allocate profits towards upgrading hardware or expanding your capabilities to boost long-term profitability.

Future of Ethereum Mining

The shift in Ethereum’s consensus mechanism from proof-of-work to proof-of-stake has fundamentally transformed the landscape of cryptocurrency engagement, rendering traditional mining operations obsolete.

As of October 2023, the Ethereum network has successfully changed to proof-of-stake (PoS) through the Ethereum 2.0 upgrade. This evolution aims to enhance scalability while reducing energy consumption by over 99%, addressing environmental concerns associated with crypto mining.

With this change, the role of miners has been replaced by validators, which secure the network by staking their ETH. Unlike the previous model, which rewarded miners for their computational efforts, the PoS system eliminates block rewards. Instead, individuals can earn rewards based on the amount of ETH they lock up in the network—essentially staking their assets rather than relying on energy-intensive mining rigs.

Engagement with Ethereum will mainly revolve around staking as users look to benefit from the new rewards structure. This shift signifies a broader trend within the crypto industry, emphasizing efficiency, sustainability, and a more equitable distribution of rewards, ultimately shaping the future of Ethereum and its community.

Frequently Asked Questions

Is Building a Crypto Mining Rig Worth It?

Building a crypto mining rig requires thorough profitability analysis, careful hardware selection, and consideration of energy consumption. Understanding mining algorithms and market volatility and implementing effective cooling solutions and maintenance tips are essential for beginners to succeed.

Do Crypto Mining Rigs Make Money?

Crypto mining rigs can generate profit margins influenced by hash rates, electricity costs, and market volatility. A thorough ROI analysis is essential, particularly when considering mining pools for consistent returns as a long-term investment strategy.

How Much Does It Cost to Build a Crypto Mining Rig?

The cost to build a crypto mining rig varies based on hardware selection, power consumption, and cooling solutions. Equipment sourcing, cryptocurrency choices, maintenance costs, and thorough profitability analysis are essential for accurate ROI calculations.

Why Is Crypto Mining No Longer Profitable?

In the crypto landscape, profitability has become a mirage, with decreased rewards, increased competition, soaring energy costs, rising hardware expenses, market volatility, regulatory challenges, and escalating mining difficulty, compounded by significant environmental impact concerns.

Summarizing

In summary, establishing a cryptocurrency mining rig presents an opportunity to navigate the complex world of Ethereum mining while potentially generating profit.

With the right equipment and strategic planning, this endeavor may seem appealing.

However, the volatile nature of the cryptocurrency market, coupled with the intricacies of hardware maintenance, suggests prospective miners should approach this venture cautiously.

After all, one can only mine for gold in a digital domain with an understanding of the ever-shifting terrain.