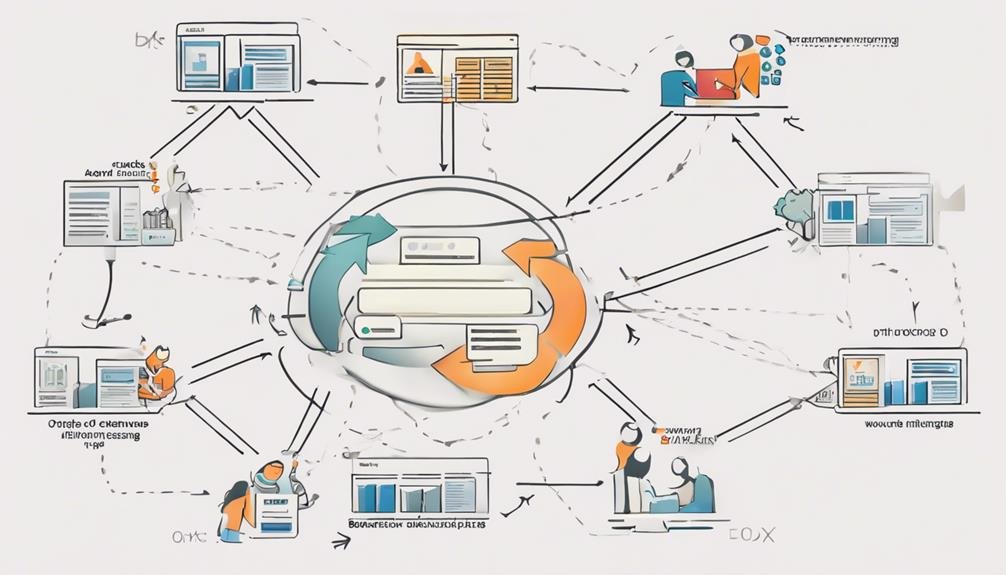

When understanding centralized exchanges (CEX), grasp essential concepts to navigate the world of digital asset trading effectively. Central entities run centralized exchanges to oversee transactions securely, implement robust security measures like 2FA and encryption, and comply with regulatory standards such as KYC procedures and AML regulations.

User-friendly interfaces simplify trading, enhance liquidity for market efficiency, and offer custodial wallet services to safeguard assets. Understanding the intricate dynamics of order book matching technology, market makers’ role in liquidity, and insurance coverage for user assets can broaden your insights into CEX operations, ensuring you make informed decisions in digital asset trading.

Table of Contents

Brief Overview of 10 Tips: Understanding Centralized Exchanges (CEX) Basics

- Centralized entities operate centralized exchanges for secure transactions.

- Implement robust security measures like 2FA and encryption for user protection.

- High liquidity on CEXs ensures price stability and attracts institutions.

- User-friendly interfaces simplify trading for beginners and attract more users.

- Compliance with regulatory standards like AML and KYC ensures legal and secure operations.

Centralized Exchanges Definition for Beginners

If you’re new to cryptocurrencies, understanding what centralized exchanges are can provide a solid foundation for your trading journey. Centralized exchanges, often called CEXs, are platforms operated by centralized entities like companies. These exchanges act as intermediaries, facilitating transactions between buyers and sellers of various cryptocurrencies under the oversight of a central authority. Users trust centralized exchanges to implement robust security measures to safeguard their funds and personal information.

Centralized exchanges offer user-friendly interfaces that make it easy for individuals to buy, sell, and trade digital assets. To start using these platforms, users typically need to create accounts, deposit cryptocurrencies into their exchange wallets, and then execute trades through the exchange’s trading mechanisms. The presence of a central authority distinguishes centralized exchanges from decentralized exchanges, giving users a sense of security and reliability in their trading activities.

Key Characteristics of CEXs

Centralized exchanges (CEXs) stand out due to their centralized nature, ensuring transactions are overseen by a single entity. Security measures play a crucial role in safeguarding users’ funds on CEX platforms. Liquidity is an essential characteristic, enhancing market efficiency by matching buyers with sellers promptly.

CEX Centralization Explained

Operating under the control of centralized entities, centralized exchanges (CEXs) serve as essential intermediaries in the trading of digital assets, ensuring secure transactions between buyers and sellers. Here are some key characteristics of CEX platforms:

- Central Oversight: CEXs are operated by centralized entities that control transactions.

- User-Friendly Interfaces: These platforms offer easy-to-use interfaces, attracting a broad user base.

- Support for Fiat Currencies: CEXs facilitate trading cryptocurrencies against traditional fiat currencies, enhancing users’ accessibility.

Centralized exchanges provide a convenient environment for trading digital assets, but their centralized nature exposes them to risks like hacking. Despite these risks, CEXs are essential in providing liquidity and market services in cryptocurrency.

CEX Security Measures

Implementing robust security measures is paramount for centralized exchanges (CEXs) to safeguard user funds and data. CEXs utilize security protocols like 2FA and encryption to bolster protection against unauthorized access. KYC procedures are mandatory on CEXs to meet regulatory requirements and prevent illicit activities. Regular third-party audits play a pivotal role in identifying vulnerabilities and enhancing overall security on these platforms.

Additionally, user information sharing is crucial in centralized exchanges to guarantee compliance with regulations and maintain transparency. Security measures on CEXs encompass the use of strong passwords, frequent security updates, and educating users to beware of phishing attempts. By adhering to these practices, CEXs can create a safer environment for users to engage in trading activities securely.

CEX Liquidity Importance

Understanding liquidity’s key role is essential to grasp centralized exchanges’ operational significance fully. Here’s why liquidity is vital on CEXs:

- High Trading Volumes: Centralized exchanges provide significant liquidity through their large user base and substantial trading volumes.

- Price Stability: Liquidity ensures that traders can easily buy and sell assets without experiencing significant price slippage, leading to lower volatility in asset prices.

- Attractiveness to Institutions: CEXs with strong liquidity are appealing to institutions seeking to execute trades efficiently, influencing market dynamics and enhancing trading opportunities for all users.

Custody and Security Measures

Centralized exchanges offer custodial services, holding users’ funds for trading purposes. Security measures, such as two-factor authentication and encryption, are in place to protect these assets. It’s crucial to grasp how custody and security protocols function in centralized exchanges to safeguard your investments effectively.

Custody Measures Overview

Custodial services provided by centralized exchanges enhance the security of your digital assets through managed wallets. Here’s an overview of how these measures work:

- Convenience: Exchange-managed wallets on CEXs eliminate the need for you to handle private keys directly, making asset management easier.

- Insurance Coverage: Insurance policies on centralized exchanges help mitigate financial losses in unforeseen events, providing reassurance about the security of your assets.

- Risk Management: Different centralized exchanges have varying insurance policies to manage risks associated with digital asset custody effectively.

These custody measures not only safeguard your investments but also offer peace of mind regarding the protection of your digital assets on centralized exchanges.

Security Protocols Explained

Enhancing the security of your digital assets on centralized exchanges involves understanding the intricacies of security protocols and custody measures in place. Centralized exchanges employ custodial wallets to safeguard user funds securely. Measures like two-factor authentication and encryption are utilized for secure communication. Adhering to Know Your Customer (KYC) procedures is vital to meet regulatory standards.

To bolster security, users must provide personal information in compliance with local laws. Strengthening your defenses includes using robust passwords, regularly updating security settings, and staying vigilant against phishing attempts. By following these practices and staying informed about regulatory standards, you can enhance the protection of your assets on centralized exchanges.

Importance of KYC Procedures

To comply with regulations and foster a secure trading environment, centralized exchanges mandate KYC procedures for users. KYC procedures on centralized exchanges play a vital role in maintaining compliance with regulatory requirements, enhancing user security, and preventing illicit activities like money laundering. Here’s why KYC procedures are essential:

- Regulatory Compliance: Centralized exchanges enforce KYC procedures to adhere to local laws and regulatory requirements, ensuring a transparent and legal trading environment.

- User Verification: By requiring users to verify their identity through KYC processes involving government-issued IDs and proof of address, centralized exchanges establish the legitimacy of traders on their platforms.

- Prevention of Illicit Activities: KYC procedures help combat money laundering, terrorist financing, and other unlawful activities by creating a barrier that deters individuals seeking to engage in such behaviors on centralized exchanges.

Ensuring compliance with KYC procedures not only safeguards the exchange but also protects the community of traders by upholding a secure and trustworthy trading environment.

Order Book Matching Technology

Order book matching technology efficiently matches buy and sell orders on centralized exchanges to facilitate trades. It pairs buyers and sellers based on their desired prices, ultimately determining the current market prices for various cryptocurrencies.

Centralized exchanges (CEXs) utilize order books to exhibit all the buy and sell orders, ensuring transparency in trading activities. This system promotes significant and transparent trading and plays a vital role in enhancing liquidity and market efficiency on CEXs. By displaying the depth of the market through these order books, users can make informed decisions about their trades.

Understanding how order book matching technology works is essential for anyone engaging in trading on centralized exchanges, as it forms the backbone of the trading process, providing a platform for buyers and sellers to interact seamlessly and securely.

Liquidity Enhancement With Market Makers

Market makers are indispensable for enhancing liquidity on centralized exchanges. By consistently providing buy and sell orders, they help guarantee a smooth trading experience for users. This role is vital in maintaining stable prices and attracting more traders to boost trading volumes.

Market Maker Role

Improving liquidity on centralized exchanges is an essential function carried out by market makers by offering buy and sell orders. Market makers play an important role in maintaining continuous trading activity by providing competitive prices, facilitating price discovery, and reducing bid-ask spreads.

Their presence guarantees a smoother trading experience for users on centralized exchanges. With market makers, the liquidity on these platforms would be much higher, impacting the efficiency and effectiveness of trading. By actively participating in the market and adjusting their orders based on supply and demand dynamics, market makers contribute to a more vibrant and liquid trading environment.

Their actions help create a more balanced and competitive marketplace for all participants.

Liquidity Provision Importance

Enhancing liquidity through the participation of market makers is crucial to fostering a robust trading environment on centralized exchanges. Market makers are vital in providing continuous buy and sell orders, ensuring ample liquidity for traders and investors.

This liquidity is essential for efficient trading, as it allows for the smooth execution of transactions without significant price fluctuations. Market makers contribute to a more stable trading environment by reducing price volatility and improving price discovery. Their presence attracts more participants to centralized exchanges, creating a vibrant marketplace where buying and selling can occur seamlessly.

Market makers act as the backbone of liquidity provision, facilitating a healthy ecosystem for traders to engage in various assets confidently.

Order Book Impact

Boosting liquidity on centralized exchanges involves understanding how market makers impact the order book, facilitating smoother execution of trades, and reducing price volatility. When centralized exchanges implement market makers, the trading environment benefits in the following ways:

- Market makers enhance liquidity by providing continuous buy and sell orders.

- They fill the gap between buyers and sellers, improving overall liquidity on the exchange.

- Market makers play an important role in reducing price volatility by always ensuring orders are available for trading.

User-Friendly Interface Benefits

With user-friendly interfaces, centralized exchanges (CEXs) greatly simplify the process of trading cryptocurrencies for beginners. These platforms offer intuitive navigation and clear instructions, making buying, selling, and trading digital assets a breeze. The interactive charts, order placement buttons, and account management tools enhance the trading experience, attracting more users to the platform.

User-friendly interfaces contribute to a positive trading experience by providing easy access to features that streamline tasks like depositing funds, executing trades, and monitoring portfolio performance. The seamless design of CEX interfaces guarantees that even those new to cryptocurrency trading can easily navigate the platform. By prioritizing user-friendly interfaces, centralized exchanges aim to make the trading process more accessible and enjoyable for all users, regardless of their experience level in the crypto market.

Compliance With Regulatory Standards

Centralized exchanges must follow strict regulatory standards to guarantee compliance with anti-money laundering (AML) regulations and other legal requirements. Ensuring compliance with regulatory standards is vital for centralized exchanges’ legal and secure operation. Here are three key points regarding compliance with regulatory standards:

- Anti-Money Laundering (AML) Regulations: Centralized exchanges must adhere to AML regulations to prevent illicit activities such as money laundering and terrorist financing. Compliance with these regulations helps maintain the financial system’s integrity and protects users from fraudulent activities.

- KYC (Know Your Customer) Guidelines: Mandatory for centralized exchanges, KYC guidelines require verifying user identities to prevent identity theft and fraud. By collecting and verifying user information, exchanges can guarantee higher security and trust among their users.

- Regulatory Requirements Vary: Regulatory requirements may differ based on jurisdiction, impacting how centralized exchanges operate in various regions. Some countries have imposed bans or restrictions on centralized exchanges due to regulatory concerns, highlighting the importance of understanding and complying with local laws and regulations.

Custodial Wallet Services Explained

To understand how custodial wallet services function on centralized exchanges, let’s explore how these services securely store users’ private keys and digital assets. When you engage with a centralized platform, you entrust your funds to custodial wallets, allowing for seamless transactions and a smoother user experience. By relying on the exchange to safeguard your private keys and digital assets, you can streamline your trading activities and access your funds conveniently.

These custodial wallet services are designed to enhance the overall user experience on centralized exchanges, making managing your assets and engaging in trading activities easier. Embracing custodial wallet services is a common practice among users on centralized exchanges, as it offers a level of convenience and ease that aligns with the centralized exchange model. Trusting the platform with your assets through custodial wallets is fundamental to effectively engaging with centralized exchanges.

Insurance Coverage for User Assets

Insurance coverage safeguards users’ digital asset holdings on centralized exchanges by protecting against financial losses in the event of unforeseen circumstances. Understanding the insurance policies offered by exchanges is essential for users to mitigate risks effectively. Here are three key points to keep in mind regarding insurance coverage on centralized exchanges:

- Variety of Policies: Different exchanges may offer varying insurance policies tailored to address specific risks associated with digital asset trading. It is vital for users to familiarize themselves with these policies to guarantee adequate protection for their holdings.

- Part of Security Measures: Insurance coverage is an integral part of the security measures implemented by centralized exchanges to enhance user reassurance. By having insurance in place, exchanges aim to provide additional protection for users’ assets.

- User Reassurance: Insurance coverage helps mitigate financial losses and reassures users about the safety of their digital asset holdings on the exchange. Reviewing and understanding these insurance provisions can offer users peace of mind.

Frequently Asked Questions

How Do Centralized Exchanges Work?

Trades are facilitated through order matching, requiring account verification when using centralized exchanges. You start by depositing fiat, paying trading fees, and then withdrawing funds. Security measures are in place, and customer support aids in moving through trading pairs.

What Is the Advantage of the Centralized Exchange CEX Over the Decentralized Exchange DEX )?

In centralized exchanges (CEXs), you’ll discover benefits in sturdy security features, seamless user experience, stringent regulatory compliance, dependable customer support, substantial trading volume, fiat support, swift transactions, and extensive liquidity pools. Immerse yourself and belong.

Is CEX Better Than Dex Liquidity?

When comparing CEX and DEX liquidity, CEXs generally offer higher market depth and trading volumes. Their order books tend to be more robust, providing a speed advantage for users. Regulatory oversight and enhanced security measures contribute to a better user experience.

Final Thoughts

To sum up, centralized exchanges (CEXs) act as the bustling marketplaces of the cryptocurrency world, where buyers and sellers come together in a digital arena. Like a well-oiled machine, CEXs provide a secure and efficient platform for users to trade their assets, with strict KYC procedures and regulatory compliance ensuring a safe environment.

With user-friendly interfaces and innovative technologies, CEXs offer a seamless trading experience akin to maneuvering a carefully orchestrated symphony of transactions.