To optimize Bitcoin mining profitability, consider these seven key tips. Understand how mining difficulty is calculated and its impact on profitability. Monitor hash rate changes as they affect block rewards. Manage electricity costs by using energy-efficient hardware and tracking peak/off-peak rates. Adapt to market conditions by analyzing trends and joining mining pools for more frequent rewards. Utilize automatic adjustments for efficiency.

Collaborate in mining pools to boost competitiveness and receive consistent rewards. Optimize hardware investments based on difficulty levels and market trends. Enhance profitability by implementing these strategies effectively. Further insights await to maximize your mining potential.

Table of Contents

Brief Overview of Calculating Mining Difficulty For Bitcoin Profitability

- Optimize energy consumption with efficient hardware.

- Stay informed on market trends and competitor strategies.

- Join mining pools for increased block-finding opportunities.

- Monitor Bitcoin price trends and difficulty adjustments.

- Utilize automatic adjustments for equipment efficiency.

Understanding Mining Difficulty Calculation

To grasp the concept of mining difficulty calculation effectively, consider the fundamental formula: difficulty equals the genesis block’s target divided by the current target. In Bitcoin mining, the importance of mining difficulty is a vital aspect that directly impacts the network’s operation. The mining difficulty is adjusted every 2016 block, roughly every two weeks, to ensure that new blocks are produced approximately every 10 minutes.

This adjustment is made based on the hash rate, which represents the total computational power of the network. The formula for calculating mining difficulty shows that the difficulty increases as the target value decreases, making it harder for miners to find a valid block hash. Understanding this relationship between difficulty, target values, and the network’s hash rate is essential for miners to predict profitability accurately.

By comprehending how mining difficulty is calculated and its direct correlation with the network’s hash rate, miners can make informed decisions to optimize their mining operations and maximize profitability within the Bitcoin network.

Impact of Hash Rate on Profitability

Monitoring and optimizing your hash rate is essential for maximizing profitability in Bitcoin mining. The hash rate, representing the total processing power in Bitcoin mining, directly impacts your chances of mining a block and earning rewards. A higher hash rate gives you a competitive edge in solving complex cryptographic puzzles, increasing the likelihood of successful block validation.

However, an increased hash rate can also lead to Mining Difficulty Adjustments, making it harder to mine new blocks and affecting profitability. Miners with higher hash rates may need more electricity to power their equipment, impacting overall profitability. It’s essential to stay updated on the market trends and adjust your hash rate accordingly to remain profitable in the ever-evolving Bitcoin mining market.

By carefully managing your hash rate and energy consumption, you can navigate the challenges posed by fluctuations in the mining rate and ensure a sustainable and successful mining operation.

Strategies for Managing Electricity Costs

When managing electricity costs in Bitcoin mining, utilizing energy-efficient mining hardware and optimizing your electricity usage based on peak and off-peak hours are key strategies. Investing in efficient equipment can lower your electricity expenses and increase your overall profitability. Monitoring and adjusting your energy consumption can help you maximize cost savings and improve the efficiency of your mining operations.

Energy-Efficient Mining Hardware

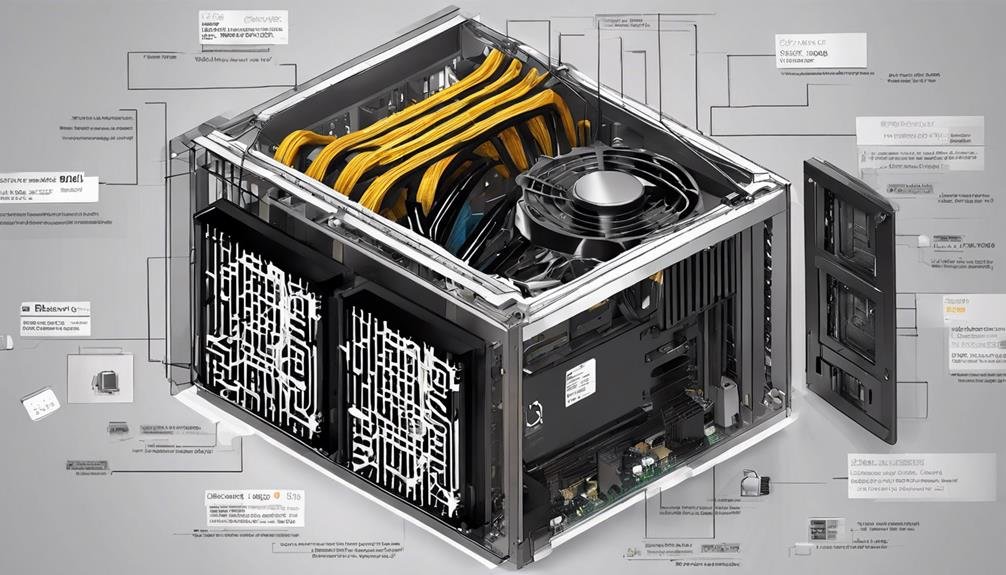

Consider upgrading to energy-efficient mining hardware like Antminer S19s to reduce your electricity costs and enhance profitability in Bitcoin mining. Energy-efficient hardware, such as Whatsminer M30Ss, can improve mining operations in competitive environments by decreasing energy consumption. Choosing hardware with high energy efficiency is essential for managing profitability and minimizing electricity costs.

Shifting to green energy sources can further optimize mining operations, balancing financial gains with environmental responsibility. Investing in energy-efficient hardware is a strategic move in today’s competitive mining landscape, where electricity costs play a significant role in profitability. By prioritizing energy efficiency in your hardware choices, you can navigate the challenges of high electricity costs and maximize your profitability in Bitcoin mining.

Time-Based Electricity Usage

To optimize your electricity costs in Bitcoin mining:

- Leverage time-based rates to capitalize on off-peak hours with lower operating expenses.

- Implement smart scheduling to run your mining equipment when reduced electricity tariffs are available. You can efficiently manage your electricity consumption using automation tools based on time-of-use pricing.

- Adjust your mining activities to align with periods of lower energy demand to optimize your electricity expenses further.

- Consider investing in energy storage solutions to store power during cheap rate periods and use it during peak hours.

By strategically planning your mining operations around time-based electricity rates and off-peak hours, you can significantly reduce your overall electricity costs and improve the profitability of your Bitcoin mining endeavors.

Adapting to Market Conditions Effectively

To adapt effectively to market conditions in Bitcoin mining, you must analyze trends and fluctuations in the market to make informed decisions. You can enhance your overall profitability by maximizing profits through strategic techniques, such as timing your mining activities during favorable conditions. It is essential to stay informed and flexible, adjusting your approach as needed to navigate the ever-changing landscape of the cryptocurrency market.

Market Analysis Strategies

Adapt effectively to market conditions by closely monitoring Bitcoin price trends, mining difficulty adjustments, and competitor strategies. Understanding the impact of halving events and network hash rate fluctuations is essential. Monitor trading volume and investor sentiment to make informed mining decisions. Assess macroeconomic factors, regulatory developments, and technological advancements to stay ahead.

Adapting mining strategies to market shifts can help optimize profitability and navigate challenges effectively. By staying informed and proactive, you can position yourself strategically in the ever-evolving landscape of Bitcoin mining. Remember, the key is to remain adaptable and responsive to the dynamic market conditions to maximize your mining profitability.

Profit Maximization Techniques

Monitoring market conditions effectively in Bitcoin mining involves closely tracking price fluctuations for strategic decision-making. Optimizing hardware utilization is vital amidst fluctuating difficulty levels to adapt to changing profitability dynamics. Joining mining pools can increase block-finding opportunities, enhancing profitability in diverse market scenarios.

Managing operating costs efficiently is essential to sustain profitability when facing varying difficulty levels. Staying informed about industry trends and network hash rate fluctuations is critical to adapting to evolving market conditions. By staying proactive and adjusting your strategies based on the current landscape, you can maximize profits in the dynamic domain of Bitcoin mining. Stay vigilant, adaptable, and ahead of the curve to safeguard your profitability in this ever-changing industry.

Leveraging Automatic Adjustments for Efficiency

Maximizing efficiency in Bitcoin mining can be achieved by strategically harnessing the power of automatic adjustments. These modifications impact miners by altering the mining difficulty based on the network’s hash rate and block time. When the block time increases, the mining difficulty decreases, making it easier for miners to validate transactions. Conversely, a lower block time leads to an increase in mining difficulty.

Miners can optimize their equipment usage and reduce costs by understanding and using these automatic adjustments. The adjustments guarantee a fair and competitive environment for all miners, enhancing profitability in the long run. Leveraging these automatic changes is essential for staying efficient and profitable in the dynamic world of Bitcoin mining. Stay informed about how these adjustments affect your mining operations to make the most out of your mining efforts.

Maximizing Profit Through Mining Pools

Considering the potential benefits of joining a mining pool, maximizing your profit in Bitcoin mining can be significantly enhanced through collaborative efforts. When participating in a mining pool, you combine your hashing power with other miners, increasing the collective competition against larger operations. This pooling of resources boosts your profitability potential by providing more consistent block rewards and a share in transaction fees based on your contribution to the pool’s overall mining efforts.

Pool mining guarantees that even if you have a smaller setup, you can still receive rewards more frequently than individual mining. Additionally, reward distribution in a mining pool is equitable and based on the work each miner contributes to the collective hashing power. By leveraging the advantages of a mining pool, you can optimize your earnings in the competitive world of Bitcoin mining.

Making Informed Hardware Investment Decisions

To optimize your hardware investments in Bitcoin mining, it is essential to carefully assess the current mining difficulty level and its impact on cost-effectiveness. The Bitcoin network’s mining difficulty levels directly affect the profitability of your mining operations. As the difficulty increases, so do electricity costs due to the higher computational power required to solve complex algorithms and earn the block reward.

Hence, when choosing mining hardware, consider the competitive nature of the industry and opt for energy-efficient equipment to maintain profitability in challenging environments. Tracking market trends and hash rate fluctuations can help you make informed decisions about your hardware investments. Additionally, joining mining pools can offset individual costs and enhance overall profitability by leveraging collective computational power.

By staying informed and strategically selecting your mining hardware based on the impact of Mining Difficulty, you can navigate the dynamic landscape of Bitcoin mining effectively to maximize your returns.

Frequently Asked Questions

Why Is Bitcoin Mining Not Profitable Anymore?

Bitcoin mining is no longer profitable due to high energy consumption, market volatility, hardware costs, maintenance expenses, intense competition, decreasing block rewards, electricity prices, mining pool fees, regulatory challenges, and network congestion.

How to Make Bitcoin Mining Profitable?

To make bitcoin mining profitable, optimize hardware efficiency, manage energy costs, choose pools wisely, use efficient mining software, consider cooling solutions, adapt to market conditions, monitor network congestion, control maintenance costs, factor in electricity rates, and maximize profit margins.

What Increases Bitcoin Mining Difficulty?

When more miners upgrade hardware, network congestion follows, raising Bitcoin mining difficulty. Increased electricity costs, competition influx, and dominant mining pools compound the challenge. Regulatory changes, block reward halving, difficulty adjustments, hashrate fluctuations, and environmental concerns further impact difficulty.

Can Bitcoin Mining Become Unprofitable?

Mining Bitcoin can indeed become unprofitable. Rising difficulty, electricity costs, market changes, and competition affect profitability. Consider hardware upgrades, efficient cooling, joining a mining pool, and adapting strategies to navigate challenges and potentially increase profitability.

Conclusion

Regarding bitcoin mining, staying informed and adapting to market conditions is vital. Did you know the total Bitcoin network hash rate has reached over 180 exahashes per second? By implementing the tips mentioned in this article, you can navigate the complexities of mining difficulty and maximize your profitability in this ever-evolving industry. Keep learning, stay proactive, and watch your mining efforts flourish.