When entering the cryptocurrency trading world, centralized exchanges (Cex) play a pivotal role with centralized order books and high liquidity levels, facilitating swift and broad trading opportunities. However, the centralized nature can pose security risks, making robust security measures imperative to protect against cyber threats like hacking.

Balancing liquidity and security becomes critical for traders on these platforms, where secure wallet storage, 2-factor authentication (2FA), and proactive monitoring of account activities are essential. Delving deeper into the functionalities of centralized exchanges will expose further insights into optimizing your trading experience.

Table of Contents

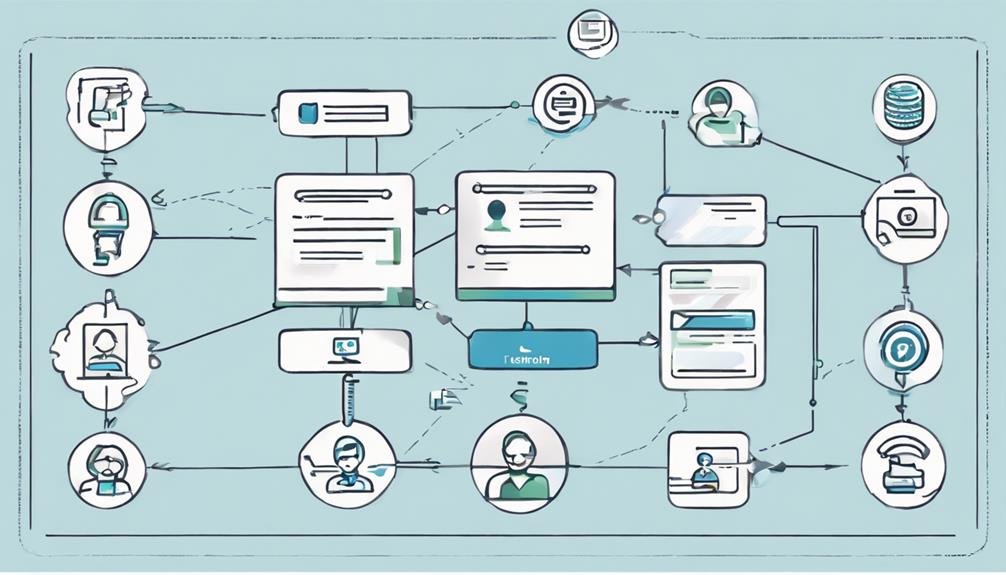

Brief Overview of How do Centralized Exchanges Work

- Understand the concept of centralized exchanges and their role as intermediaries.

- Learn about account registration, verification, and security measures like 2FA.

- Explore trading pairs, liquidity, order matching, and the trading process.

- Discover the importance of security features and protecting personal information.

- Familiarize yourself with the differences between centralized and decentralized exchanges.

Overview of Centralized Exchanges

Centralized exchanges operate as the primary intermediaries for cryptocurrency transactions, facilitating the buying and selling digital assets through user deposits. These exchanges boast high liquidity levels, making it easier for you to buy or sell your favorite cryptocurrencies quickly. Liquidity is vital in trading, ensuring enough buyers and sellers to match your orders efficiently. However, with great convenience comes great responsibility.

Centralized exchanges are susceptible to hacking attacks due to their centralized nature, emphasizing the critical need for robust security measures. These platforms use various security protocols to safeguard your funds and personal information from cyber threats. Understanding how centralized exchanges balance liquidity with security measures enables you to make informed decisions when engaging in cryptocurrency trading. Remember, staying informed and cautious is essential in this fast-paced digital landscape.

Definition of Centralized Exchanges (Cex)

Centralized exchanges, or CEXs, play a pivotal role in cryptocurrency trading. They function as intermediaries, matching buy and sell orders in a centralized order book. Understanding the characteristics and pros and cons of CEXs is essential for effectively traversing the crypto trading landscape.

Cex Characteristics Explained

When utilizing centralized exchanges (CEXs) for cryptocurrency trading, you engage with platforms that act as intermediaries between buyers and sellers. Here are the vital characteristics of CEXs:

- Centralized Order Book System: CEXs operate with centralized order books, efficiently matching buy and sell orders.

- Identity Verification: These exchanges require users to undergo identity verification processes and comply with KYC/AML regulations to guarantee security.

- Funds Storage: CEXs store users’ funds in wallets on the platform, which can pose a potential security risk if not adequately safeguarded.

Understanding these characteristics is crucial when considering where to trade digital assets securely. Examples of prominent CEXs include Bitstamp, Binance, Coinbase, and Huobi.

Cex Pros and Cons

Considering the advantages and disadvantages of centralized exchanges<span data-preserver-spaces=”true”> (Cex), weighing the benefits and drawbacks of trading on these platforms is crucial. Centralized exchanges offer a familiar trading environment similar to traditional online brokerages, providing security measures, quick transactions, and the option to refund funds in case of any issues.

However, there are risks associated with Cexs, including a lack of transparency, custody of user funds, censorship risks, technical glitches, and the potential for bankruptcy. It’s essential to be cautious when using centralized exchanges due to the possibility of losing assets stored on the platform and historical exchange hacks like Mt. Gox and Bitfinex. To enhance security and control your digital assets, transferring purchased cryptocurrencies from a Cex to a personal wallet is advisable.

Key Characteristics of Cex

Centralized exchanges, or CEXs, exhibit vital characteristics that set them apart in cryptocurrency trading. These characteristics include robust security features to protect users’ assets, high liquidity levels due to a large user base, and the availability of a wide range of trading pairs. Understanding these features is essential for exploring the world of centralized exchanges effectively.

Cex Security Features

Centralized exchanges (CEXs) implement robust security features and protocols to safeguard your assets and personal information. When using a CEX, you can expect the following security measures:

- Secure Wallet Storage: CEXs typically store users’ funds in secure wallets to prevent unauthorized access.

- Advanced Encryption: CEXs employ advanced encryption techniques to protect users’ personal information and assets.

- Two-Factor Authentication (2FA): Many CEXs offer 2FA to enhance account security, requiring a second verification step beyond the password.

These security practices help guarantee that your assets and transactions are protected on centralized exchanges.

Liquidity on Cex

When trading on centralized exchanges (CEXs), one notable feature that significantly impacts your trading experience is the ample liquidity available. High liquidity on CEXs results from the significant number of users and trading volume on these platforms. This liquidity guarantees that your trades can be executed quickly and efficiently, with minimal price slippage.

CEXs offer a wide range of trading pairs, enhancing market depth and providing abundant opportunities for buying and selling digital assets at competitive prices. The high liquidity found on CEXs attracts individual traders and institutional investors seeking to execute large orders quickly. A key characteristic of CEXs is liquidity, making them appealing options for traders looking for a robust trading environment.

Trading Pairs Availability

Amidst the diverse offerings of centralized exchanges, the availability of trading pairs stands out as a critical characteristic defining the trading experience. When exploring centralized exchanges, understanding the availability of trading pairs is essential for making informed investment decisions. Here are three vital points to ponder:

- Wide Range of Options: Centralized exchanges offer a variety of trading pairs, including cryptocurrency-to-cryptocurrency and fiat-to-cryptocurrency pairs, allowing you to diversify your portfolio.

- Regulatory Influence: The availability of fiat-to-cryptocurrency pairs is influenced by regulatory requirements and partnerships with traditional financial institutions, impacting the ease of access for new investors.

- Facilitating Accessibility: Popular exchanges like Coinbase, Kraken, and Gemini provide fiat-to-cryptocurrency pairs, enabling users to directly purchase cryptocurrencies using traditional fiat currencies such as USD, EUR, or GBP.

Centralized Vs. Decentralized Exchanges

Centralized exchanges, relying on a central authority, differ remarkably from decentralized exchanges that operate without intermediaries. In a centralized exchange, transactions are facilitated, and a central authority maintains order books. On the other hand, decentralized exchanges function without a central intermediary, utilizing intelligent contracts or peer-to-peer networks to enable trading.

Centralized exchanges boast high liquidity levels and a broad range of trading options compared to their decentralized counterparts. However, decentralized exchanges prioritize user control and privacy, albeit potentially at the cost of lower liquidity levels. Centralized exchanges are subject to regulatory oversight and compliance requirements. In contrast, decentralized exchanges operate in a more autonomous and decentralized manner.

Understanding the distinctions between centralized and decentralized exchanges can help you decide which type aligns better with your priorities when trading cryptocurrencies.

Order Matching on Cex

Moving from the discussion on centralized versus decentralized exchanges, let’s focus on how order matching works on centralized exchanges, specifically on Cex. When trading on Cex, order matching is essential to execute buy and sell orders efficiently. Here’s how it works:

- Price and Quantity Matching: Orders are matched based on the specified price and quantity, ensuring that trades are executed at the desired parameters.

- Order Book Display: Centralized exchanges like Cex utilize order books to showcase buy and sell orders for different cryptocurrencies, providing transparency to traders.

- Fair Trading Process: The order matching process on Cex aims to promote fair trading by pairing compatible orders and maintaining market integrity.

User Accounts on Cex

When creating a user account on a centralized exchange (CEX), you will go through an account registration process, including providing personal information for identity verification. To enhance security, implementing measures like 2-factor authentication is essential to safeguard your account from unauthorized access. Additionally, CEXs often have varying levels of account verification requirements based on the extent of information they provide.

Account Registration Process

Upon creating an account on a centralized exchange (CEX), you will be prompted to provide personal information, such as your name, email, and address. This process guarantees that the exchange can verify your identity and provide a secure environment for trading.

- Verification: Some CEXs may require additional documents like government-issued IDs or proof of address for identity authentication.

- Security Features: Account registration often involves setting up security measures such as two-factor authentication (2FA) to safeguard your account.

- Functionalities: Once registered, users access features like depositing funds, placing buy/sell orders, and monitoring their portfolio on the CEX.

Completing the account registration process allows you to engage in trading activities and securely store your cryptocurrencies on the centralized exchange.

Security Measures for Accounts

After completing the account registration process on a centralized exchange, ensuring the security of your account becomes vital. Centralized exchanges require personal information for identity verification, making it essential to implement robust security measures. Utilize two-factor authentication (2FA) to protect your account effectively. Setting up strong passwords and changing them regularly enhances your account’s security.

Additionally, centralized exchanges may offer extra security features like IP restrictions and withdrawal whitelists to safeguard your account further. Regularly monitoring your account activity and promptly reporting any suspicious behavior can help prevent unauthorized access. By taking these security measures seriously, you can better protect your user account on centralized exchanges.

Account Verification Requirements

To comply with regulatory standards and guarantee a secure trading environment, centralized exchanges mandate users to undergo account verification procedures, known as KYC. When creating an account on a centralized exchange, you will typically encounter the following requirements:

- Personal Information: You must provide identification documents, proof of address, and sometimes even a selfie to verify your identity.

- Compliance with Regulations: Account verification is necessary to meet regulatory requirements and deter fraud and money laundering.

- Verification Tiers: Some exchanges offer different verification tiers with varying limits on trading and withdrawal amounts, depending on the level of verification you complete.

Deposit and Withdrawal Processes

When depositing funds on centralized exchanges, you have the option to use fiat currency or cryptocurrencies. Deposits can be made securely through various payment methods accepted by the exchange. Once your funds are in your account, you can proceed with trading or investing in different assets on the platform.

Withdrawal processes on centralized exchanges typically involve submitting a request and confirming the transaction to guarantee the security of your funds. Some exchanges may have withdrawal limits or fees for certain transactions, so be mindful of these factors when making withdrawals.

Withdrawal times can vary based on the exchange and the type of asset being withdrawn, so it’s advisable to check the specific terms and conditions of the exchange. Remember to follow the recommended security protocols when making withdrawals to safeguard your assets and minimize any potential risks associated with the process.

Advantages of Centralized Exchanges

Centralized exchanges provide traders with high liquidity, facilitating quick and efficient trades. This liquidity guarantees that you can buy or sell assets without significant price slippage, making executing trades at desired prices easier. Here are some advantages of centralized exchanges:

- Diversification Opportunities: Centralized exchanges typically offer a wide range of listed cryptocurrencies, allowing you to diversify your investment portfolio quickly and take advantage of various trading opportunities.

- User-Friendly Interfaces: These platforms often provide intuitive interfaces with real-time charts and trading tools, making it more straightforward to navigate the exchange and make informed trading decisions.

- Security Measures in Place: Despite risks, centralized exchanges implement robust security measures to protect your funds and personal information. These security protocols help create a secure environment for cryptocurrency trading, giving you peace of mind while engaging in transactions.

Disadvantages of Centralized Exchanges

Despite the conveniences centralized exchanges offer, they come with several drawbacks that users should be aware of. One significant risk is the higher probability of hacking attacks due to the concentration of funds in a single entity. This makes centralized exchanges attractive targets for cybercriminals seeking to exploit vulnerabilities and steal users’ assets.

Additionally, security breaches on these platforms can result in users losing their stored assets, highlighting the importance of robust security measures. Lack of transparency within centralized exchanges can also lead to market manipulation, where unfair practices may impact users’ trading experiences.

Centralized exchanges’ custody of user funds raises concerns about the safety and control of digital assets, as users have to trust the exchange to safeguard their investments. It’s essential to be cautious of these risks to make informed decisions when engaging with centralized exchanges.

Functionality of Centralized Exchanges

Exploring the functionality of centralized exchanges reveals their pivotal role in facilitating seamless trading experiences for cryptocurrency users. Centralized exchanges offer a range of features that cater to beginners and experienced traders, making them popular platforms for buying, selling, and trading digital assets. Here are three critical aspects of centralized exchanges:

- User-Friendly Interfaces: Centralized exchanges provide intuitive interfaces that make it easy for users to navigate the platform, execute trades, and monitor their investments effectively.

- Advanced Trading Tools: These exchanges offer various trading options, including margin trading, stop-loss orders, and market analysis tools, empowering users to make informed decisions and maximize their trading strategies.

- High Liquidity and Trading Volumes: Unlike decentralized exchanges, centralized platforms typically have higher liquidity and trading volumes, allowing users to buy and sell assets quickly at competitive prices. However, this increased activity also attracts risks, such as potential security vulnerabilities and regulatory scrutiny. Users must know these factors and take necessary precautions to safeguard their assets.

Frequently Asked Questions

How Do Centralized Exchanges Work?

Centralized exchanges work by matching buy and sell orders in their order books, tapping into liquidity pools to facilitate trades. They charge transaction fees, providing a structured environment for users to engage in trading activities efficiently.

What Is the Downside of Centralized Exchanges?

When using centralized exchanges, you face security risks, lack privacy, and have limited control over your funds. Your assets are vulnerable to hacks, and your trading activities may be restricted, affecting your financial autonomy.

What Are Decentralized Exchanges for Dummies?

Decentralized trading is like a digital swap meet where you exchange assets directly. P2P transactions cut out intermediaries, giving you more control. Trustless platforms guarantee security without needing to depend on a central authority.

Which Crypto Exchange Is Best for Beginners?

Coinbase welcomes you with its easy interface and compliance when starting in crypto. Binance offers a wide array of coins for your exploration. Kraken’s secure platform guides you through. Gemini focuses on security. Bitstamp keeps it simple.

Final Thoughts

In summary, centralized exchanges offer a convenient way for beginners to trade cryptocurrencies easily. Understanding the key characteristics, advantages, and disadvantages of Cex is vital for making informed decisions.

But have you ever wondered how centralized exchanges will evolve in the future to adapt to the changing landscape of the cryptocurrency market? Only time will tell.